Each year, the J.P. Morgan Healthcare Conference provides a unique lens into the direction of global healthcare investment. It is where capital, innovation, and long-term strategy intersect.

This year’s edition was marked by a clear sense of optimism.

Across our discussions with investors, partners, and industry leaders, three signals stood out consistently: artificial intelligence was central to nearly every conversation, capital is progressively returning after several constrained years, and there is a renewed willingness to foster partnerships and strategic alliances.

More than anything, JPM 2026 reflected a more constructive and disciplined market environment — one focused on execution, value creation, and sustainable growth.

Investors Key Takeaways from JPM 2026

The tone across meetings was pragmatic and forward-looking.

Capital is re-engaging, supported by more rational valuations and clearer expectations on performance. Business development activity was intense, with strong interest in partnerships and platform-based strategies. At the same time, a rebound in healthcare M&A is broadly expected to continue into 2026.

Within this context, our conversations confirmed a major shift underway in diagnostics.

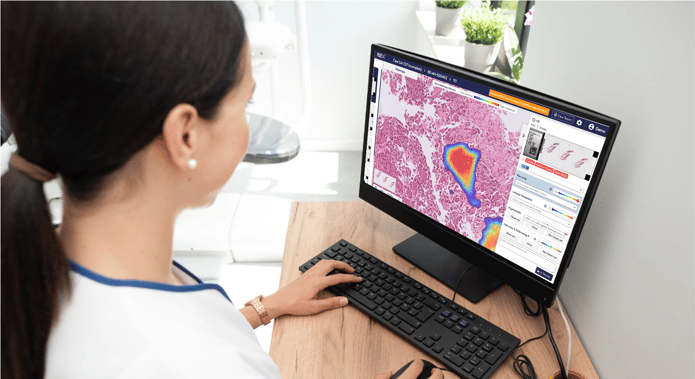

Digital Pathology is transitioning from an innovation technology to a strategic healthcare infrastructure, with significant growth potential ahead.

Platforms that are AI-ready, clinically adopted, and capital-efficient are increasingly viewed as well positioned to attract both financial investors and strategic exit opportunities in the mid-term.

Digital Pathology as Strategic Infrastructure for Oncology

One message emerged with remarkable clarity: digital pathology is now viewed as foundational infrastructure for precision medicine and oncology care pathways.

As cancer care becomes more personalized and data-driven, pathology plays a central role: supporting diagnosis, prognosis, biomarker analysis, patient stratification, and therapy decision-making.

Investor interest is particularly strong in platforms that:

- Integrate deeply into routine clinical workflows

- Aggregate scanners, data, and AI through a vendor-agnostic approach

- Create long-term customer stickiness within broader product portfolios

- Support both clinical care delivery and pharma or translational research needs

This evolution positions digital pathology not as a departmental tool, but as a strategic layer within modern healthcare systems.

Platform and AI: From Innovation to Scalable Value

AI was present across all healthcare segments at JPM 2026, yet the nature of the conversation has clearly evolved.

Value is no longer defined by algorithms alone.

Investors are increasingly focused on platforms that demonstrate:

- Proven deployments in reference hospitals and laboratories

- Clear regulatory pathways, including CE-IVD and FDA frameworks

- AI embedded directly within regulated clinical workflows

- Measurable impact on productivity, quality, and process acceleration — across both care delivery and life sciences

The emphasis has shifted decisively toward scale, adoption, and evidence.

AI is becoming most valuable when it is operational, trusted, and integrated into daily clinical practice.

Cancer and Diagnostics as Core Value Creation Engines

Oncology remains the primary investment and M&A driver across life sciences.

Strong momentum continues around biomarkers, companion diagnostics, and advanced therapeutic modalities such as antibody–drug conjugates (ADCs). In this environment, digital pathology is increasingly recognized as a critical enabler — connecting tissue-based data with therapeutic innovation.

Its role spans the full continuum: from diagnosis to research, from clinical decision-making to therapy development.

This central position reinforces the strategic importance of pathology platforms within the broader oncology ecosystem.

Valuation Drivers in Digital Pathology

Across discussions with investors, several valuation drivers consistently emerged for digital pathology companies:

- Strong and predictable financial KPIs

- A robust go-to-market strategy leveraging multiple partners and channels

- Defensible barriers through deep integrations, platform lock-in, and high switching costs

- Regulatory credibility supported by strong data governance

- A central role within the end-to-end oncology workflow

Together, these elements define the next generation of high-value healthcare platforms.

What This Means for Tribun Health

At Tribun Health, our strategy has long been aligned with these fundamentals.

Our enterprise-grade digital pathology platform is already deployed across hospitals and laboratory networks, and we continue to expand its capabilities — enabling integrated workflows, vendor-agnostic data aggregation, and scalable AI adoption.

The conversations we held at JPM 2026 strongly reinforced this direction.

We return encouraged by the quality of exchanges, the maturity of the market, and the growing recognition of digital pathology as a cornerstone of modern diagnostics.

The opportunity ahead is significant — and we are committed to building long-term value for healthcare systems, partners, and investors alike.

Jean-François Pomerol

Chief Executive Officer

Tribun Health

Follow Tribun Health on LinkedIn for updates on digital pathology, AI, and enterprise-scale innovation. #DigitalPathology #AIinPathology #EnterpriseImaging

.png?width=256&height=256&name=customer-service(1).png)

.png?width=64&height=64&name=calendrier(1).png)

.png?width=64&height=64&name=communique-de-presse(1).png)

.png?width=64&height=64&name=livre(1).png)

.png?width=64&height=64&name=blog(2).png)